Argentina’s Hard Reset: Can Milei’s Austerity Fix a Broken System?

Chainsaw economics and the early results of Javier Milei’s economic overhaul.

When Javier Milei took office as the President of Argentina on the 10th of December 2023, the challenges were large and omnipresent. He inherited a broken economy with a government budget deficit of 15%, soaring inflation at more than 300% annually1 and a government debt to GDP ratio of 155%. Add to that strict capital controls and a massive welfare state that had largely stopped delivering any welfare and you get the picture.

Argentina’s economic (mis)fortunes over the last century have been well documented so in trying to keep this light and easily digestible I won’t expand on the history too much. Suffice it to say that at the beginning of the 20th century Argentina was one of the richest nations on Earth, by 1930 it ranked among the top 10 nations in GDP per capita. There was even a saying, “to be as rich as an Argentine”. Fast forward a hundred years and Argentina is the only nation in the world to have gone from a former first-world economy to a middle-income economy, rather than the reverse.

Javier Milei

Milei was elected essentially as an anti-establishment candidate. He was an economics professor and TV commentator who in a harsh and populist-like manner pushed back heavily against political mismanagement of the economy and the people he sees as responsible for the current mess, the “Peronistas”.2 Milei is a classic libertarian and an avid supporter of the Austrian and the Chicago schools of economics, mostly Friedrich Hayek, Ludwig von Mises and Milton Friedman. In layman’s terms this means a heavy emphasis on free market economics and an underlying assumption that any government intervention is a net negative in purely economic terms. Therefore, the state should, in order to optimize economic efficiency, ideally be as small as possible.3

The Chainsaw

From the moment he took office, Milei moved quickly. Within days, he launched what he called a “chainsaw plan”, a radical package of economic shock therapy aimed at slashing public spending, deregulating the economy and restoring fiscal balance. He issued emergency decrees scrapping over 300 regulations, including rent caps, price controls and labor protections. He also cut energy and transport subsidies, cancelled or merged nine out of eighteen ministries, fired more than 30,000 public workers and imposed a hiring freeze. His mantra: “There is no money.”

The early months of 2024 were marked by uncertainty. Previous governments had relied heavily on money printing to finance the massive 15% deficit spending. They, in order to keep the peso from devaluing, artificially pegged the peso and introduced capital controls to prohibit people from trading their increasingly worthless pesos against other currencies. The results of these policies were economically disastrous and also resulted in a black currency market where pesos could be traded for dollars at a vastly different rate than the official one.

Breaking the Cycle

After heavily cutting spending Milei halted the money printing and devalued the peso to a lower rate against the dollar, one much closer to the black market rate. This is painful in the short term because devaluing a currency causes things to be more expensive in real terms and so causing, in effect, another inflationary spike. Inflation, already out of control, spiked further but by March, there were glimmers of hope. Because of heavily reduced government spending, monthly inflation began to cool, suggesting the worst of the monetary storm might be passing.

By April, the first real signs of stabilization appeared. For the first time in over a decade, Argentina posted a monthly budget surplus. The peso began to settle, the gap between official and black-market exchange rates narrowed, and investor sentiment started to improve. Exporters benefited from loosened trade rules, and foreign interest in Argentina’s economy, particularly in energy and mining, began to pick up.

Through the rest of 2024 and into 2025, Milei stuck with his plan. Privatizations were rolled out, starting with Aerolíneas Argentinas and major energy firms. A tax reform package was introduced to streamline Argentina’s notoriously complex system, and labor reforms were proposed to reduce informality and improve flexibility.

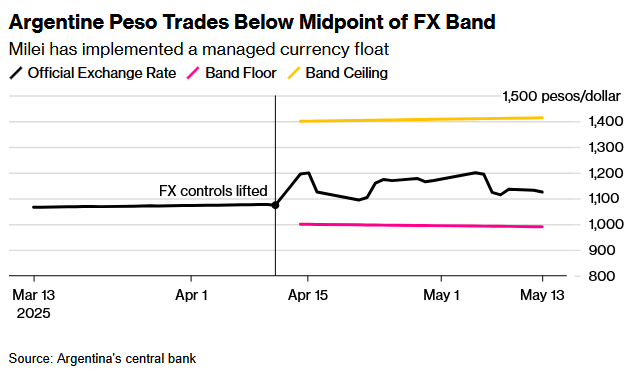

The biggest step towards normalizing the economy was taken in April this year when Milei was able to remove the last of the capital controls. Argentina secured a 20 billion dollar package from the IMF which gave the central bank enough leeway to support the peso.4 Milei’s team implemented a managed currency float by depegging the peso from the dollar and letting it float free between the established band floor and band ceiling. This was done to establish some trust by markets that the central bank will intervene if the peso starts devaluing much more than anticipated, but that the intention is to let the currency float freely. By removing the last capital controls people and businesses are again free to move money in and out of the country, allowing and encouraging foreign investment, which is essential for an open and trade-friendly economy.

The pain of adjustment however, has been real. Because of the cut in government spending, the percentage of people living in poverty went up from around 42% to 53% and the economy contracted slightly for the first few months of 2024. Yet amid the undeniable hardship, some key numbers are heading in the right direction. As of April 2025, monthly inflation is at 2.8%5, the budget is balanced, and economic growth of 5-6%6 is expected this year. The percentage of Argentines living in poverty is now around 38%7, lower than when Milei first took office.

The Road Ahead

Ideological differences remain however. Left-wing Peronist voters are in favour of a large welfare state and see the measures taken by Milei as anti-social and a threat to the less fortunate. The upcoming midterms (26th of October 2025) will therefore be crucial. Midterms are often seen as a referendum on the President’s performance and a win for Milei would make maintaining and introducing further reforms much more straightforward. His party, La Libertad Avanza (LLA), currently holds a significant minority of seats in both houses of Congress, a win would change that. Milei’s approval ratings have so far remained steady, with most pollsters having him hovering below the 50% mark8, which is relatively high historically and for South America in general. Many now hope that Argentina might finally be turning a corner.

Whether Milei’s bold program will leave Argentina with lasting reform or simply another chapter of volatility remains to be seen. But for now, the signs of stabilization are real, and the world is watching closely.

https://www.reuters.com/world/americas/argentinas-inflation-expected-have-accelerated-27-december-2025-01-13/

https://www.lemonde.fr/en/opinion/article/2024/01/17/javier-milei-s-election-in-argentina-leaves-peronism-in-disarray_6440295_23.html

https://mises.org/mises-daily/chicago-school-versus-austrian-school

https://www.economist.com/the-americas/2025/04/14/javier-mileis-big-move-to-normalise-argentinas-economy

https://www.reuters.com/world/americas/argentina-monthly-inflation-slows-more-than-expected-april-2025-05-14/

https://www.reuters.com/world/americas/argentina-economic-activity-grows-57-february-2025-04-22/

https://www.ft.com/content/2b2d4f40-93b3-4251-8473-3729a778a7b1

https://www.piie.com/blogs/realtime-economics/2025/milei-2025-between-argentinas-mid-term-elections-and-imf